One other forecast for the UK economic system was upgraded at this time amid indicators of rising confidence amongst enterprise chiefs.

Within the newest chinks of sunshine, analysts on the EY ITEM Membership revealed they now don’t count on the nation to stoop into recession this yr.

As an alternative the group anticipates 0.2 per cent progress in GDP – removed from spectacular however an enormous enchancment on the 0.7 per cent fall it was pencilling in as lately as January.

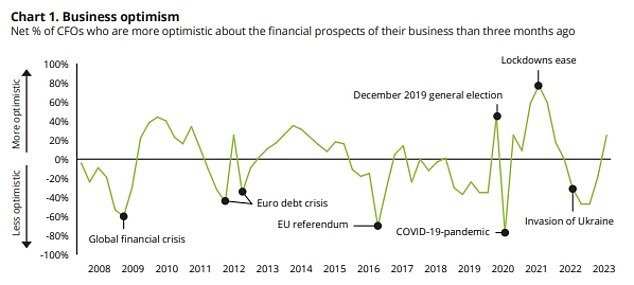

In the meantime, separate analysis from Deloitte discovered the largest rise in confidence for the reason that Covid vaccine rollout started on the finish of 2020.

Jeremy Hunt was given a great addition at this time as one other forecast for the UK economic system was upgraded

Separate analysis from Deloitte discovered the largest rise in confidence for the reason that Covid vaccine rollout started on the finish of 2020

Chancellor Jeremy Hunt took a swipe at latest dire forecasts from the IMF final week, insisting that the outlook appeared ‘brighter than anticipated’.

Though the IMF upped its prediction for UK GDP for 2023 and 2024, the worldwide physique mentioned Britain would have the worst progress of all the large industrialised economies.

However after the ONS revealed figures exhibiting marginal progress over the previous three months regardless of public sector strikes, Mr Hunt mentioned he believed the UK would keep away from a technical recession. That’s outlined as two consecutive quarters of contraction.

Mr Hunt informed IMF managing director Kristalina Georgieva that he was ‘very centered on proving you flawed’ on the physique’s assembly in Washington final week.

EY’s newest ITEM Membership evaluation recommend the economic system will flatline within the first half of 2023 earlier than bettering from the summer time, when dropping wholesale power costs will subdue inflation.

‘The UK economic system appears to be turning a nook, albeit very slowly,’ mentioned Hywel Ball, EY’s UK chairman.

The EY evaluation mentioned inflation would come underneath 3 per cent by the top of 2023, an enchancment on January’s forecast of slightly below 4 per cent.

Analysts count on CPI to dip under double digits for the primary time since final summer time when March’s information is revealed on Wednesday.

Headline inflation unexpectedly jumped in February to 10.4 per cent from 10.1 per cent in January, after document grocery value hikes as a result of salad shortages.

The EY group warned that the economic system just isn’t but out of the woods, with Britons nonetheless feeling the pinch.

But it surely recommended that information of the economic system outperforming expectations ‘may assist stir a revival in enterprise and shopper confidence’.

Finance executives at high British corporations have reported the sharpest rise in optimism since late 2020, based on the quarterly survey by Deloitte.

The Deloitte survey discovered that the sting had come off a few of the monetary executives’ worst fears within the newest quarter

The web distinction between those that anticipated an enchancment and those that anticipated issues to worsen was 25 proportion factors.

The metric has been working under the long-term common studying of minus two for the final yr.

‘Crucially, finance leaders report little change in credit score circumstances, suggesting that March’s occasions within the world banking system haven’t affected the pricing and availability of credit score for UK corporates,’ Deloitte Chief Economist Ian Stewart mentioned.

Worries about Brexit and the surge in power costs had light, Mr Stewart mentioned.

A giant majority of CFOs anticipated to see a big progress in capital spending on AI over the following 5 years. Two thirds mentioned such know-how would assist elevate Britain’s weak productiveness progress.

The survey of 64 CFOs – 11 of them from FTSE 100 corporations and 24 from FTSE 250 firms – was performed between March 21 and April 3

#forecast #upgraded #present #dodging #recession