The Financial institution of England warned householders right now to anticipate excessive curiosity and mortgage charges for years to return, despite the fact that the worst of the spike in prices might quickly be over.

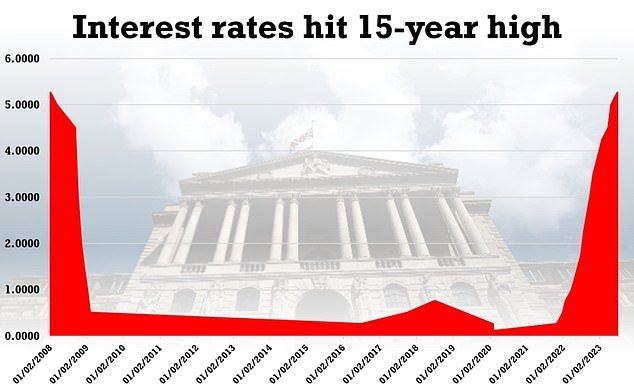

The Financial institution’s Financial Coverage Committee elevated the bottom fee by 0.25 share factors right now, taking it to five.25 per cent – a stage final seen in 2008.

However whereas the transfer will come as a blow to these on tracker and most variable-rate mortgages, some lenders signalled they’d not go on the most recent rise.

Consultants steered that better-than-expected inflation figures final month meant that the speed rise had largely been factored into offers already.

However the Financial institution right now hosed down hopes of a return to decrease charges earlier than the center of the last decade.

Deputy Governor Ben Broadbent stated it had to make sure charges had been ‘sufficiently restrictive’ over the medium time period – often deemed to be two to 5 years – to ensure inflation stays low.

How will the rate of interest hike have an effect on YOU? Electronic mail eirian.prosser@dailymail.co.uk

UK Client Costs Index (CPI) inflation was 7.9 per cent in June, slowing from 8.7 per cent in Might, in accordance with the Workplace for Nationwide Statistics (ONS).

The Financial institution stated right now it believed inflation would fall to 4.9 per cent by the tip of the yr, however Client Costs Index (CPI) inflation will stay above 2 per cent till mid-2025.

Amanda Aumonier, from the net mortgage dealer Higher.co.uk stated: ‘Whereas the preliminary influence of the base-rate hike would possibly fear householders, particularly for these with a tracker mortgage, it is essential to understand that the bottom fee is just one issue that impacts how lenders value fixed-rate mortgages.

‘Growing the bottom fee goals to handle inflation and we lastly noticed constructive indicators that this technique was beginning to work final month. What occurs to inflation this month can have a big influence on how lenders modify fixed-rate mortgages within the coming weeks and months.’

Santander determined to chop fixed-rate mortgage provides this morning, earlier than the financial institution’s determination, though it has handed on the rise to variable fee clients.

Skipton Constructing Society stated right now it might not go on the rise to variable fee clients.

The Financial institution of England hiked rates of interest by one other 0.25 share factors right now to succeed in 5.25 per cent, a fee final seen in 2008 in the course of the monetary disaster

Demonstrators sporting masks depicting Britain’s Prime Minister Rishi Sunak and the Governor of the Financial institution of England Andrew Bailey at a protest outdoors the Financial institution right now

Andrew Bailey emphasised that inflation hurts lower-income households probably the most, which is why the Financial institution has opted for ‘restrictive’ financial coverage.

Chancellor Jeremy Hunt acknowledged the rise in rates of interest could be a ‘fear’ for households and companies, however insisted the Authorities should follow its plan to carry down inflation.

Mr Hunt stated it was essential to not ‘veer round like a purchasing trolley’ and comply with the Authorities’s present path to satisfy its key aim of halving inflation.

In a lift for the Prime Minister and Chancellor, the Financial institution of England stated earlier right now it expects the Authorities to satisfy that promise by the tip of the yr.

Mr Hunt stated: ‘Any rise in rates of interest is a fear for households with mortgages, for companies with loans. What the Financial institution of England governor is saying is now we have a plan that’s bringing down inflation, solidly, robustly and persistently.

‘So the plan is working, however what now we have to do as a Authorities is that we follow that plan, we do not veer round like a purchasing trolley.’

Stephen Perkins, managing director of Yellow Brick Mortgages, stated: ‘Charges ought to stay steady and even barely scale back as lenders really feel extra assured the bottom fee is reaching its peak. The one bulletins from lenders right now have an effect on tracker mortgages and their variable charges rising, which is nothing out of the peculiar. The actual query for banks is how lengthy will it take them to go the speed enhance on to savers.’

The policymakers additionally indicated that rates of interest would want to remain comparatively increased for longer in an effort to carry inflation again all the way down to its 2 per cent goal.

Chancellor Jeremy Hunt stated: ‘If we follow the plan, the Financial institution forecasts inflation might be beneath 3 per cent in a yr’s time with out the financial system falling right into a recession.

‘However that does not imply it is easy for households dealing with increased mortgage payments, so we’ll proceed to do what we are able to to assist households.’

Indicators that inflation has turned a nook have fuelled hopes that policymakers might quickly take their foot off the fuel over fee rises.

The 14th consecutive rise comes amid indicators that the UK financial system is slowing beneath the load of upper rates of interest.

Mortgage holders on tracker offers face almost £24 per thirty days being added to their funds, on common, following the rise.

The MPC stated that a number of the dangers from extra persistent inflation, notably wage progress, had ‘begun to crystalise’, prompting it to push borrowing prices increased.

Home costs fell on the quickest annual fee in 14 years in July, after housing affordability was stretched for individuals seeking to purchase a house with a mortgage, Nationwide stated.

The Financial institution revealed its MPC was cut up 6-3 over the speed rise. Six members of the nine-strong Financial Coverage Committee (MPC) opted to extend the bottom fee by 0.25 share factors.

However two others, Jonathan Haskel and Catherine Mann, voted for an even bigger half-point enhance, whereas one member, Swati Dhingra, most well-liked to maintain the speed at 5 per cent.

Shadow Chancellor Rachel Reeves stated: ‘This newest rise in rates of interest might be extremely worrying for households throughout Britain already struggling to make ends meet.

‘The Tory mortgage bombshell is hitting households laborious, with a typical mortgage holder now paying an additional £220 a month after they go to re-mortgage.

‘Accountability for this disaster lies on the door of the Conservatives that crashed the financial system and left working individuals worse off, with increased mortgages, increased meals payments and better taxes.’

Primarily based on the mortgages excellent, the rise will add on £23.71 sometimes to month-to-month tracker funds, in accordance with figures from the commerce affiliation UK Finance, including as much as almost £285 per yr.

For householders on an ordinary variable fee mortgage, the typical cost might enhance by £15.14 per thirty days or almost £182 per yr.

SVRs are set by particular person lenders and sometimes comply with actions within the base fee.

The Governor of the Financial institution of England stated he anticipated inflation on the value of products will ease over the remainder of this yr.

Andrew Bailey emphasised that inflation harm lower-income households probably the most, which is why the Financial institution had opted for a ‘restrictive’ financial coverage.

He added: ‘We do recognise, and I believe it is crucial to say, that inflation has a really critical impact, notably on these least nicely off.’

The principle elements of inflation – power and meals – make up an even bigger portion of spending for decrease earnings households, he stated.

‘However I’ll emphasise that the financial system is extra resilient. Sure, unemployment has gone up a bit, however it’s nonetheless at traditionally low ranges.

‘We have not skilled a recession and we’re not forecasting one.’

Mr Sunak has purpose to have a good time because the Financial institution of England forecast that he would meet his promise to halve inflation by the tip of this yr.

The Financial institution forecast stated that resulting from drops in worldwide power costs, inflation was set to fall to round 4.9 per cent averaged over the ultimate three months of 2023.

Inflation was working at 10.7 per cent within the closing quarter of final yr, that means that to hit their goal ministers must hope for inflation, measured by the Client Costs Index (CPI, would fall to five.3 per cent.

However assembly the aim was largely out of the Authorities’s fingers. One of many principal instruments for combating inflation is rates of interest, that are set by the Financial institution of England.

The slowing housing market has had a knock-on impact on a variety of housebuilders and builders’ retailers, which have flagged a lot weaker demand for properties.

Moreover, progress in Britain’s providers sector slowed final month as issues over rates of interest and the financial outlook took a toll on shopper demand, the monetary consultancy S&P International stated in its PMI survey.

Rishi Sunak stated yesterday that inflation was not falling as quick as he would love, however that folks can ‘see gentle on the finish of the tunnel’.

In the meantime, banks are beneath extra stress to go fee rises on to savers.

Myron Jobson, senior private finance analyst for Interactive Investor, stated: ‘There is likely to be a bit extra urgency amongst banks and constructing societies to go on the bottom fee rise to their financial savings merchandise this time round because the Monetary Conduct Authority has just lately gained new powers to take sturdy actions in opposition to these providing unjustifiably low charges.’

The FCA shared a 14-point motion plan this week to ensure savers had been being provided higher offers.

How will the rate of interest hike have an effect on YOU? Electronic mail eirian.prosser@dailymail.co.uk

#Financial institution #England #warns #curiosity #charges #keep #excessive #years #elevating #base #fee #15year #peak #consultants #hope #mortgage #ache #peaked #lenders #vow #mounted #provides