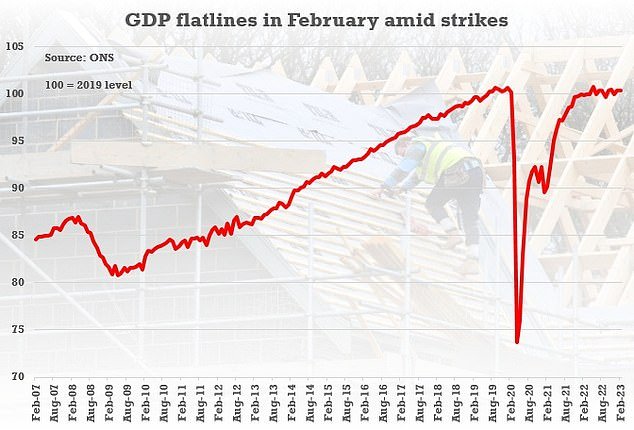

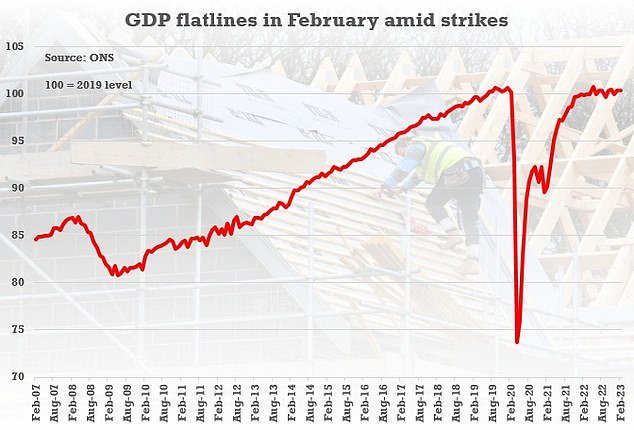

- UK financial system stayed degree in February regardless of the influence of public sector strikes

Jeremy Hunt took a veiled swipe on the IMF immediately after figures confirmed the British financial system flatlined in February.

GDP held its degree over the month because the influence of public sector strikes worn out a restoration within the building sector.

Nonetheless, progress for January was revised up barely from 0.3 per cent to 0.4 per cent. And over the latest three months to February UK plc nudged up by 0.1 per cent.

After the IMF gave its newest dire predictions about Britain’s prospects, Mr Hunt insisted the outlook was ‘brighter than anticipated’ and the nation is on observe to keep away from recession.

‘The financial outlook is trying brighter than anticipated – GDP grew within the three months to February and we’re set to keep away from recession due to the steps we now have taken by a large bundle of price of residing help for households and radical reforms to spice up the roles market and enterprise funding,’ he mentioned.

GDP held its degree over February, with industrial motion blamed for a fall in exercise in schooling and authorities

Jeremy Hunt took a veiled swipe on the IMF immediately after figures confirmed the British financial system flatlined in February

ONS Director of Financial Statistics Darren Morgan mentioned: ‘The financial system noticed no progress in February general. Building grew strongly after a poor January, with elevated restore work going down.

‘There was additionally a lift from retailing, with many retailers having a buoyant month.

‘These have been offset by the consequences of Civil Service and academics’ strike motion, which impacted the general public sector, and unseasonably delicate climate led to falls in the usage of electrical energy and fuel.’

A technical recession is outlined as two consecutive quarters of contraction, one thing the UK has not suffered for the reason that big Covid hit.

The IMF marginally upgraded its forecast for UK GDP this 12 months and subsequent in its World Financial Output report earlier this week.

However regardless of the development, it estimated that Britain will nonetheless have the worst progress within the G7 group of superior nations in 2023 and 2024.

Germany is the one European nation that can have worse progress this 12 months, and Italy subsequent 12 months, the IMF discovered.

Even Russia was predicted to have stronger progress than Britain – though economists warned that the physique had a patchy observe file and figures must be taken with an enormous pinch of salt.

The report confirmed that general superior economies are set to have slower progress than creating economies.

UK output is predicted to contract by 0.3 per cent this 12 months earlier than rebounding to develop by 1 per cent subsequent 12 months, economists working for the physique mentioned.

However it’s a minimum of higher information than a earlier IMF forecast, which predicted that the financial system would shrink by 0.6 per cent this 12 months.

The IMF upgraded its forecast for UK GDP this 12 months and subsequent in its World Financial Output report immediately. However regardless of the development, it should nonetheless have the worst progress within the G7 group of superior nations in 2023 and 2024.

Commercial

#British #financial system #flatlined #February #strikes #wiped #building #restoration