Council tax is predicted to rise by 5 per cent a yr for the following 5 years after Jeremy Hunt ditched guidelines forcing city halls to carry referendums.

The common Band D invoice is predicted to be £250 greater by 2027-28 after the Chancellor slipped the transfer by means of within the Autumn Assertion.

So far councils have been required to place any plans to bump up tax by greater than 2 per cent to the general public in a vote, alongside a 1 per cent to fund social care.

Treasury sources admitted that 95 per cent will make the most of the brand new most.

The tweak contributes to an eye-watering squeeze for Britons over the following two years, which can wipe out eight years of progress in residing requirements.

It means Band D households in a few of England’s costliest boroughs may face a council tax hike of greater than £114 within the coming yr.

The OBR watchdog stated: ‘This modification is predicted to yield £4.8billion a yr by 2027-28, equal to growing the typical Band D council tax invoice in England by round £250 (11 per cent) in that yr.’

Need to know the way a lot your council tax may improve by? Sort the title of your native authority into the field under to disclose the potential rise:

If councils make the most of the brand new guidelines to hike tax by 5%, some areas may see a Band D house owner hit with payments of greater than £2,300. If each native authority did it, solely Westminster and Wandsworth would see tax payments for these properties stay below £1,000

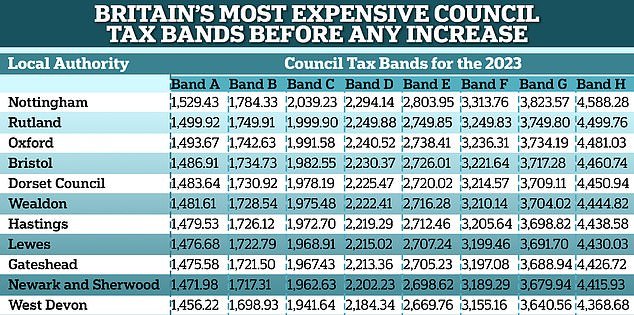

In a few of Britain’s costliest councils tax payments are already above £2,200 for a Band D house

In Nottingham, which has the very best fee of council tax within the nation, a Band D house may see a hike to their invoice of £114.71 to £2,408.85, if the native authority makes use of its new powers.

Different areas resembling Rutland and Oxford may see will increase of greater than £112 for a Band D family, whereas in Mr Hunt’s South West Surrey constituency, it may leap by £108.92 for a similar sort of house.

The common quantity of council tax paid on a Band D house may leap by £98.30 to pushing the imply from £1,966 to £2,064.30 nationwide.

In the meantime, for these residing in Band H properties, which is the very best tax fee, may see rises of greater than £200 if councils take up the choice of accelerating it by 5 per cent.

Whereas areas with the very best council tax at current may see the most important will increase, it might additionally hit different elements of the nation laborious.

In Stoke-on-Trent, which is a part of the Pink Wall that swung the Tories in 2019, Band D owners may see their tax invoice rise by £89.85 to £1,886.85.

Jonathan Gullis, the Conservative MP for Stoke-on-Trent North, advised The Instances permitting council’s to extend tax to such an extent is ‘a really blunt mechanism’.

‘Most significantly and worst of all, those that are most weak in Bands A to D will likely be hit within the pocket even tougher,’ he stated.

‘Hitting individuals on low incomes even tougher within the pocket on the time of a value of residing disaster will undermine belief, significantly in public providers the place individuals will query whether or not they’re getting worth for cash.’

Even in London, which has the most affordable charges of council tax within the nation, owners may face an unwelcome hike of their payments.

In Westminster, which has the bottom fee within the nation, a Band D house may see £43.21 added to their tax invoice, bringing it £907.34.

If each native authority elevated tax by 5 per cent, Westminster and Wandsworth (£926.23) could be the one councils in England the place tax payments would stay under £1,000.

The transfer to present councils the power to boost taxes by a lot will show controversial.

However the Authorities will argue that the rises wouldn’t be ‘extreme’ as inflation is at the moment operating at greater than 10 per cent.

Some Conservative MPs have warned towards loosening the principles amid fears that council tax rises may backfire in subsequent yr’s native elections.

Bob Blackman, the Conservative MP for Harrow East, advised The Instances: ‘For my part, council tax must be set at an area degree.

‘Nevertheless, by easing or taking away the referendum lock, the political danger is that Conservative-run councils will get blamed for growing council tax.

‘It may make the native elections much more difficult subsequent yr.’

The transfer has been criticised by one main suppose tank, which stated eradicating the cap would go away households ‘uncovered’.

John O’Connell, chief govt of the TaxPayers’ Alliance, stated: ‘Elevating the cap on council tax rises will depart households uncovered to surging payments.

‘Native authorities are undoubtedly dealing with greater overheads, however important fee will increase cannot be justified whereas self-importance initiatives and exorbitant salaries persist.

‘As an alternative of anticipating taxpayers to bear a larger burden, councils should rein in wasteful spending and decide to maintaining prices down.’

#council #tax #Interactive #module #reveals #hike #have an effect on #households