An even bigger-than-expected fall in shopper worth inflation has boosted market expectations that the Financial institution of England will go for a smaller base price hike on Thursday.

Workplace for Nationwide Statistics Knowledge on Wednesday confirmed annual CPI fell from October’s 41-year excessive of 11.1 per cent to 10.7 per cent, prompting cautious optimism that the worst of worth pressures are over and inflation has now peaked.

The Metropolis had already been anticipating a 50 foundation factors (bps) rise from tomorrow’s Financial Coverage Committee resolution, including 0.5 per cent to take base price from 3 per cent ro 3.5 per cent.

That is down from the 75bps base price hike on the November assembly, and the ONS figures have buoyed this conviction.

Charges are going up: Governor of the Financial institution of England Andrew Bailey is predicted to ship a 50bps hike on Thursday

Ought to the BoE observe by with a 0.5 share level rise on Thursday, it could mark the financial institution’s ninth consecutive hike and take the bottom price to three.5 per cent.

Previous to Wednesday’s figures, expectations that the BoE would increase charges by a smaller quantity have been pushed by the necessity to stability combating inflation with making certain these efforts don’t push Britain into an much more extreme recession.

In latest months, BoE figures have cautioned markets that charges are unlikely to peak as excessive as consensus recommended on the time.

Macro strategist for international fastened revenue at Goldman Sachs Asset Administration Gurpreet Gill mentioned: ‘We anticipate the Financial institution to undertake a much less aggressive price enhance of 0.5 per cent this month, after November’s sharp 0.75 per cent rise.

‘Whereas latest GDP knowledge shocked to the upside, progress momentum is weak justifying a slower strategy to tightening.’

Nevertheless, Gill cautioned that ‘broad-based inflationary pressures’ nonetheless persist, that means the BoE is unlikely to cease mountain climbing the bottom price any time quickly.

Peaking early? The headline CPI price fell from 11.1% in October to 10.7% in November

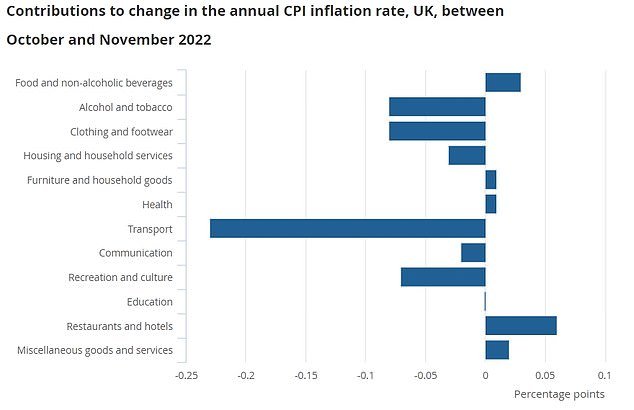

The primary downward inflation issue was transport, with prices of motor fuels rising extra slowly

Separate ONS knowledge reveals wage progress, which is a key determinant of inflation, continues to tick greater as employers scrap to draw and retain workers amid the hovering price of dwelling.

Not accounting for inflation, common common pay progress for the personal sector was 6.9 per cent in August to October, and a pair of.7 per cent for the general public sector, in line with the ONS.

Whereas the Metropolis sees a smaller hike at tomorrow’s assembly as close to sure, head of market technique at monetary providers agency Ebury Matthew Ryan mentioned the transfer will possible have an effect on sterling and traders ought to maintain a detailed eye on the MPC’s commentary.

He mentioned: ‘We’re pencilling in one other 50bps hike, though we suspect that the choice on the magnitude of the speed enhance shall be removed from unanimous.

‘Assuming we see no shock on charges, the response in sterling will, subsequently, possible be decided by each the voting sample amongst committee members and the financial institution’s communications in its assertion and assembly minutes.

‘Within the occasion of a 50bps price hike, and an more and more divided committee, we predict that sterling may sell-off, notably ought to the assertion or assembly minutes as soon as once more push again towards present market pricing for UK rates of interest.

‘That mentioned, one other 75bps hike can’t be dominated out completely. This is able to be bullish for GBP, given present market pricing.’

#Financial institution #England #hike #curiosity #charges #tomorrow