Jeremy Hunt headed for Parliament immediately as he vows to ‘get Britain rising’ by reducing taxes and cracking down on the workshy.

In an important Autumn Assertion, the Chancellor will draw battle traces for a protracted election battle by beginning to scale back the eye-watering burden on companies and households.

He’s anticipated to chop Nationwide Insurance coverage in a transfer that can profit 28million Brits, in addition to making everlasting a £10billion-a-year tax break for companies.

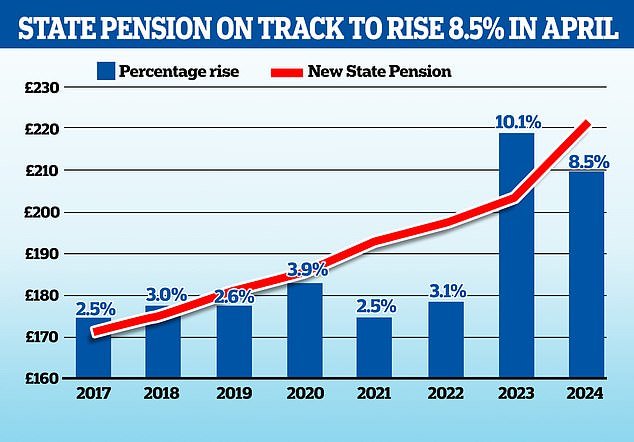

There shall be excellent news for state pensioners, with the triple-lock honoured in full – that means an 8.5 per cent hike, equal to round £18 every week for many.

Advantages will even be elevated by 6.7 per cent after Mr Hunt backed away from utilizing a decrease uprating determine – however as much as two million incapacity claimants will face more durable guidelines on discovering work the place doable.

Duties on beer, wine and spirits, and pubs and bars are broadly predicted to be frozen, whereas bars might have their 75 per cent enterprise charges vacation prolonged.

The Cupboard met this morning to be briefed on the contents of the bundle, with sources saying the temper was ‘buoyant’.

Earlier than leaving No11, Mr Hunt mentioned the assertion would come with ‘110 completely different measures to assist develop the British financial system‘ saying they might make a ‘actually huge distinction’.

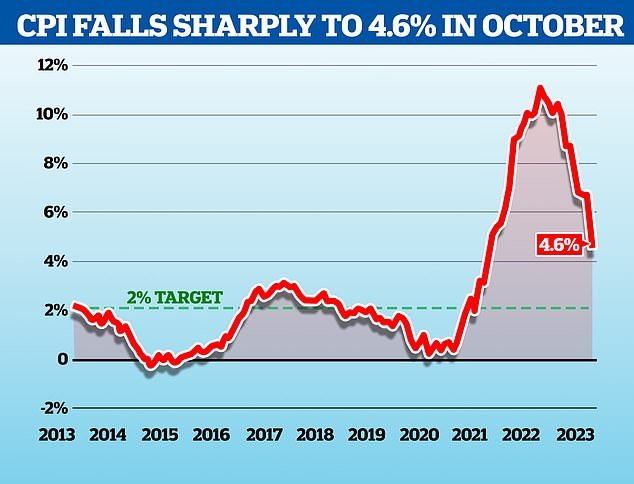

He has been handed some wriggle room by bigger-than-anticipated tax revenues and easing inflation.

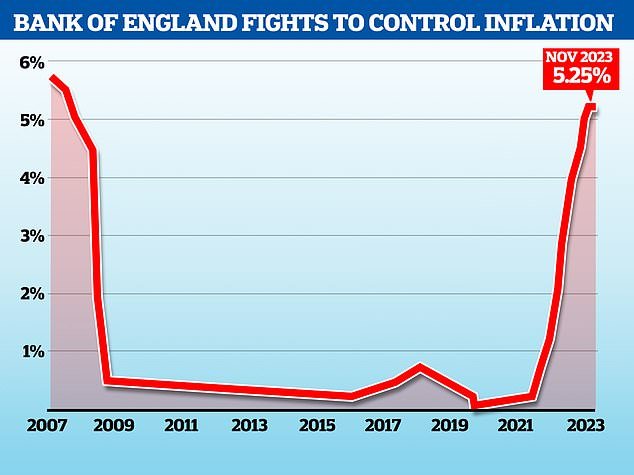

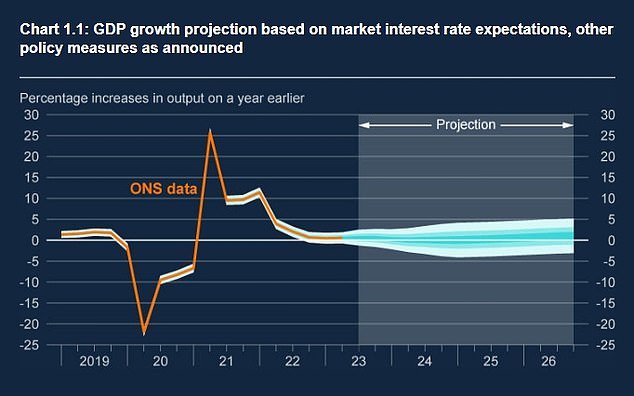

Nonetheless, the fiscal place stays extremely tight, with the Workplace for Price range Accountability (OBR) watchdog prone to downgrade forecasts for financial development and the Financial institution of England warning that the inflation menace has not disappeared.

Jeremy Hunt headed for Parliament immediately as he vows to ‘get Britain rising’ by reducing taxes and cracking down on the workshy

Rishi Sunak and the Chancellor briefed Cupboard on the contents of the Assertion immediately

Mr Sunak and Mr Hunt had been mentioned to be in ‘buoyant’ temper as they outlined the measures to colleagues this morning

Lord Cameron was among the many ministers in Downing Avenue this morning to be briefed on the contents of the Autumn Assertion

At Cupboard this morning, Mr Sunak flagged earlier predictions that the UK financial system would fall into recession.

Because of this the UK’s financial coverage might ‘change gear with a give attention to decreasing debt, reducing tax and rewarding arduous work, constructing home, sustainable vitality, backing British enterprise and delivering world-class training’.

The Chancellor informed colleagues that the bundle ‘backs enterprise and rewards employees to get Britain rising’.

‘He significantly pointed to tackling the issue of 100,000 folks being signed onto advantages with no necessities to search for work due to illness or incapacity, saying that it’s a waste of potential that’s each economically and morally flawed and that the Again to Work plan would help over 1,000,000 folks to seek out work,’ a No10 readout mentioned.

Mr Hunt is anticipated to declare that the financial system is ‘again on observe’ as a part of his assertion when he takes to the Commons in a while Wednesday.

Mr Hunt has additionally signed off an 8.5 per cent improve within the state pension, according to the so-called ‘triple lock’, rising the worth of the brand new state pension by £17.33 every week – or greater than £900 a 12 months.

The Chancellor will say that ministers are charting a brand new course on the financial system and rejecting ‘huge authorities’ within the wake of the Covid pandemic and a world spike in vitality costs, which have pushed each Authorities borrowing and the tax burden to document ranges.

‘Conservatives know {that a} dynamic financial system relies upon much less on the choices and diktats of ministers than on the vitality and enterprise of the British folks,’ he’ll say.

‘In immediately’s Autumn Assertion for Development, the Conservatives will reject huge authorities, excessive spending and excessive tax as a result of we all know that results in much less development, no more.’

Treasury sources mentioned immediately’s bundle can be focused at boosting Britain’s flagging financial development price.

The most important ticket merchandise shall be a everlasting extension of the so-called ‘full expensing’ scheme, which permits companies to offset the price of capital funding towards company tax.

Sources mentioned the £10billion-a-year scheme was ‘the largest enterprise tax lower in fashionable British historical past’.

Most of immediately’s assertion will give attention to development, together with measures to encourage pension funds to put money into the UK and plans to supply households residing close to the pylons wanted to improve the nationwide grid as much as £1,000 a 12 months off vitality payments.

Mr Hunt predicts the measures will ‘improve enterprise funding within the UK financial system by round £20billion a 12 months over the subsequent decade’.

Levies on beer, wine and spirits are anticipated to be frozen – having solely been overhauled in August.

A 75 per cent enterprise charges vacation for pubs and bars can also be set to be prolonged, giving publicans a much-needed increase.

The Chancellor can also be anticipated to scale back the speed of nationwide insurance coverage for workers and the self-employed, which might profit 28million employees.

A one proportion level lower would value £5billion and save these incomes £50,000 or extra round £380 a 12 months.

Nonetheless, there may be not anticipated to be any motion to the Nationwide Insurance coverage and tax thresholds, which have been frozen till April 2028.

Critics have accused the Authorities of imposing a ‘stealth tax’ on folks that can see them paying extra NI contributions ought to wages improve.

Reductions in private taxation are anticipated to be modest, with extra to observe in March’s Price range.

Ministers have ditched plans to squeeze profit funds, that means they are going to rise by 6.7 per cent subsequent 12 months primarily based on the September inflation price.

There had been solutions of utilizing the October inflation price of 4.6 per cent as a baseline for profit will increase – a transfer that may have saved the federal government £3bn.

However Mr Hunt will unveil a ‘carrot and stick’ bundle of measures designed to encourage two million working age folks to get a job.

The Chancellor is anticipated to verify that the state pension will rise by 8.5 per cent in April

The federal government has been given respiratory room by the sharp fall in inflation in October

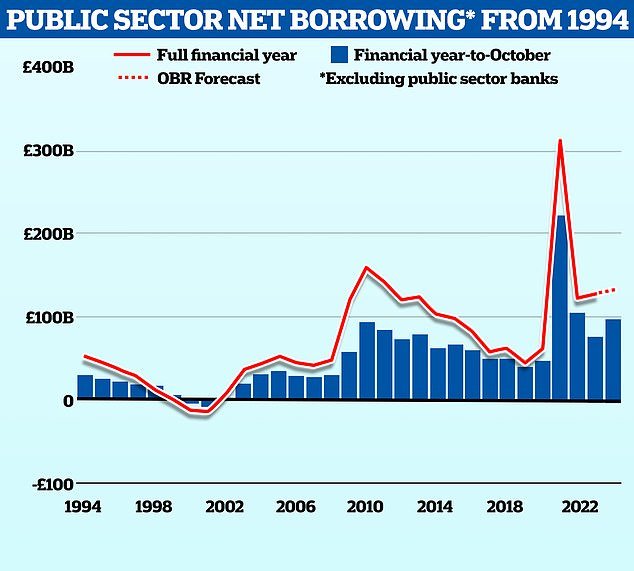

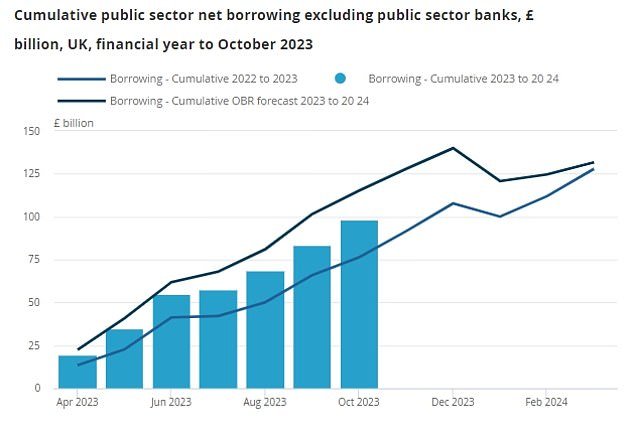

Public sector borrowing stays at traditionally excessive ranges after the pandemic

The Financial institution of England has pushed up charges to fight costs and has warned they’re prone to keep excessive for a while to return

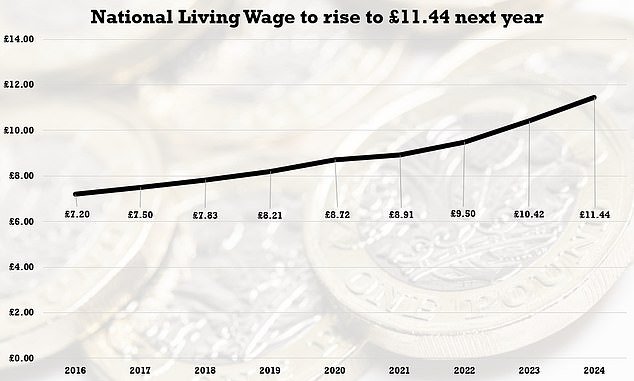

The Autumn Assertion comes scorching on the heels of a hike within the Nationwide Dwelling Wage by a couple of pound an hour

Borrowing in October was greater than the £13.7billion anticipated by the Workplace for Price range Accountability (OBR) watchdog – the primary time it has overshot the official forecasts this monetary 12 months

The BoE’s forecasts recommend that the financial system will endure gradual development within the coming years

Publishing his Autumn Assertion on the financial system, the Chancellor (pictured) will attempt to rebuild the Tories’ fame as a low-tax get together with a focused bundle of measures geared toward serving to each enterprise and households

Official figures yesterday confirmed borrowing was £16.9billion decrease than anticipated.

The Workplace for Nationwide Statistics mentioned it stood at £98.3billion for the April to October interval – greater than on the similar interval final 12 months however decrease than the £115.2billion forecast by the OBR in March.

Nonetheless, in a worrying signal the October borrowing got here in above predictions, and was the best ever outdoors of Covid.

The information got here because the Treasury introduced plans to extend the Nationwide Dwelling Wage by greater than a pound an hour from subsequent April.

The speed – which will even be prolonged to 21-year-olds for the primary time – will rise from £10.42 to £11.44.

Nationwide minimal wage for 18 to 20-year-olds will even improve by £1.11 to £8.60 per hour, the Authorities has mentioned.

Apprentices can have their minimal hourly charges boosted, with an 18-year-old in an trade like development seeing their minimal hourly pay improve by over 20 per cent, going from £5.28 to £6.40 an hour.

There will even be a drive to get thousands and thousands of individuals off advantages and again to work. Earlier this month, we reported on plans to impose more durable sanctions on those that declare unemployment advantages.

The Division for Work and Pensions plans to withdraw free prescriptions and dental therapy from those that refuse to interact with efforts to seek out them a job.

Throughout Britain, 1.57million persons are in receipt of Jobseekers Allowance, Common Credit score or each – the Chancellor’s plans are anticipated to focus on round 1.1million of these, together with these with long-term well being circumstances.

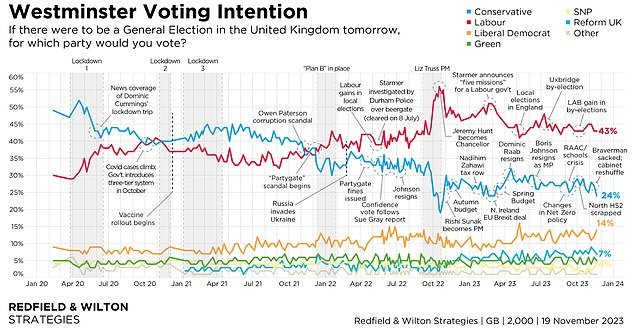

The wealth of tax cuts come because the Tories attempt to stave off a Labour landslide within the subsequent common election, which might happen in autumn subsequent 12 months.

Polling has persistently put Labour forward within the polls with a double-digit lead. The latest YouGov polls earlier this month put Labour 23 proportion factors forward of the Tories on 44 per cent.

One other ballot discovered that 32 per cent of voters believed Sir Keir Starmer can be the most effective prime minister, versus 22 per cent for Mr Sunak.

And up to date polling for the Mail discovered that Labour was extra prone to be regarded as a celebration of low taxes in comparison with the Conservatives.

Schooling Secretary Gillian Keegan was all smiles as she arrived for Cupboard this morning

Extra polls have painted a bleak image of the Conservatives’ prospects, with Redfield & Wilton Methods placing Labour 19 factors forward

#Hunts #daring #plan #Britain #rising #Chancellor #heads #Parliament #prepares #lower #Nationwide #Insurance coverage #funds #28m #Brits #hand #companies #tax #breaks #give #OAPs #additional #week #bumper #Autumn #Assertion #TODAY