Britain’s June heatwave helped heat up the financial system as new figures immediately confirmed better-than-expected development.

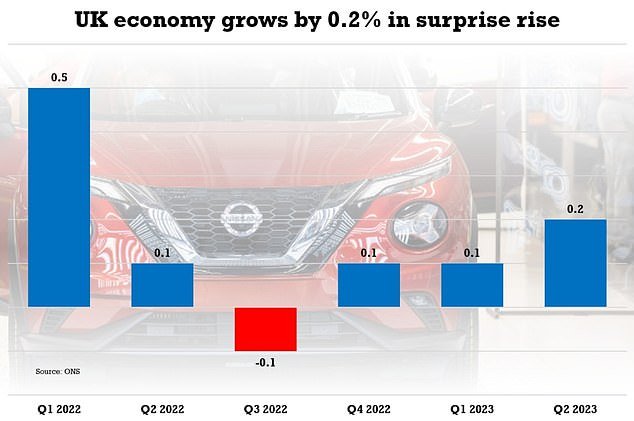

The UK financial system grew by 0.2 per cent within the second quarter of the yr – with a 0.5 per cent in June alone.

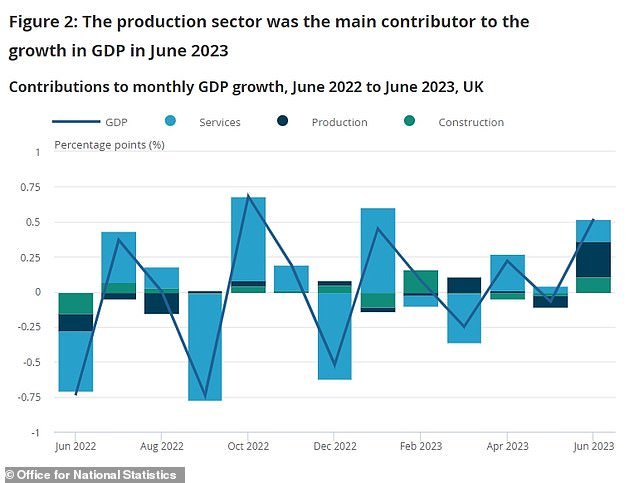

The Workplace for Nationwide Statistics (ONS) stated June’s sunny climate had inspired Britons to eat out and drink extra – boosting GDP. Will increase in manufacturing and IT companies additionally helped the financial system.

This yr noticed the most popular June on report, with the Met Workplace recording a median temperature of 15.8C (60.4F). The earlier excessive of 14.9C (58.8F) was recorded in 1940 and 1976.

However the washout July that adopted means that the third quarter figures could not profit from such a seasonal enhance.

Economists had anticipated GDP to develop by 0.2 per cent in June and 0.0 per cent within the quarter as an entire. It grew by 0.1 per cent within the first quarter of the yr.

The information is a great addition for the Authorities, which has made combating inflation its high precedence, even when excessive rates of interest sparked a drop in development.

The UK financial system grew by 0.2 per cent between April and June, based on information from the ONS

This yr noticed the most popular June on report, with the Met Workplace recording a median temperature of 15.8C (60.4F)

The ONS stated: ‘The biggest optimistic contribution to development was from the data and communication sub-sector which grew by 1.0 per cent, with the most important will increase in movement image, video and TV programme manufacturing, and pc programming, consultancy and associated actions.

‘The subsequent largest optimistic contribution to development was from lodging and meals service actions which elevated by 1.6 per cent.

‘This was pushed by meals and beverage companies which noticed a very robust month in June, with anecdotal proof from the month-to-month enterprise survey suggesting that good climate and a rise in dwell occasions boosted turnover for companies.’

Chancellor Jeremy Hunt stated: ‘The actions we’re taking to combat inflation are beginning to take impact, which implies we’re laying the robust foundations wanted to develop the financial system.

‘The Financial institution of England are actually forecasting that we are going to keep away from recession and, if we stick with our plan to assist individuals into work and enhance enterprise funding, the IMF have stated over the longer-term we are going to develop sooner than Germany, France and Italy.’

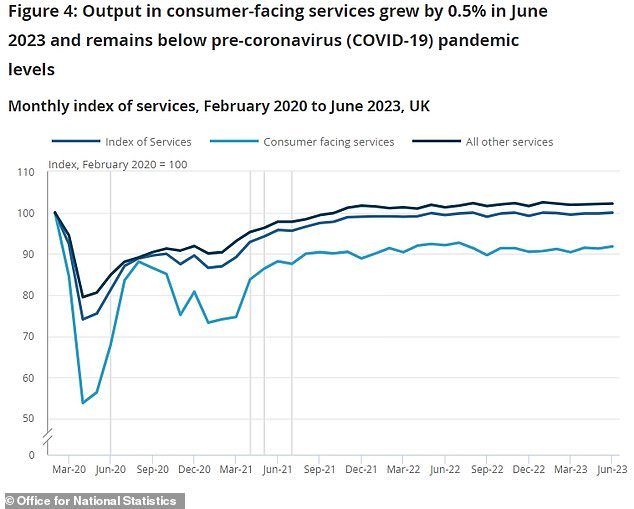

Nonetheless, quarterly GDP continues to be 0.2 per cent beneath the place it was within the ultimate three months of 2019, earlier than the Covid-19 pandemic hit and compelled the nation into lockdown.

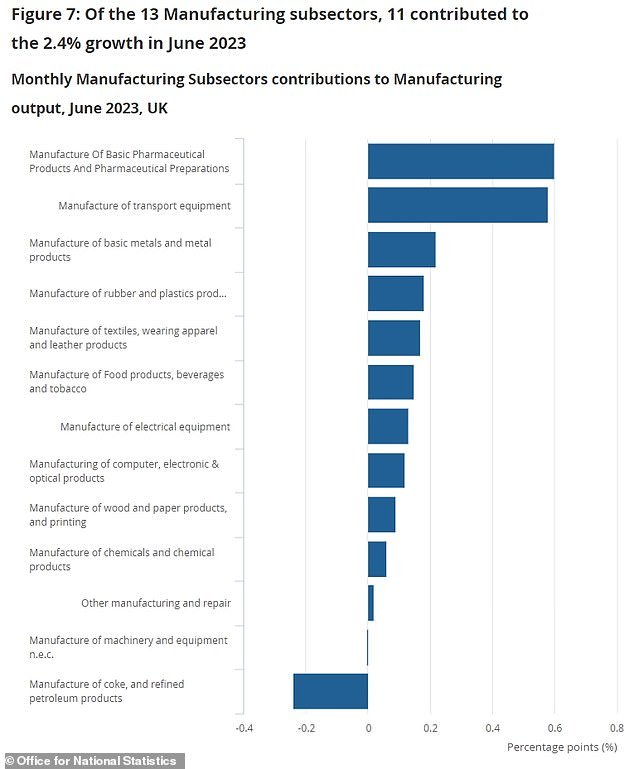

ONS director of financial statistics Darren Morgan stated: ‘The financial system bounced again from the results of Might’s additional financial institution vacation to report robust development in June. Manufacturing noticed a very robust month with each automobiles and the often-erratic pharmaceutical trade seeing notably buoyant development.

‘Companies additionally had a powerful month with publishing and automobile gross sales and authorized companies all doing nicely, although this was partially offset by falls in well being, which was hit by additional strike motion.

‘Development additionally grew strongly, as did pubs and eating places, with each aided by the new climate.’

Companies informed the ONS that their output had elevated in June to make up for the additional financial institution vacation in Might.

The statisticians discovered that the human well being and social work sector had weighed on GDP in June, shrinking by 0.8 per cent. There have been 4 days of strikes by junior docs through the month though nurses had not been on strike.

The brand new information places the UK on a greater course to keep away from falling right into a recession, which is outlined as two quarters in a row the place GDP shrinks.

Nonetheless, forecasts from the Financial institution of England see development remaining sluggish for years to come back.

Shadow Chancellor Rachel Reeves stated: ‘Progress within the financial system continues to be on the ground.

’13 years of financial mismanagement below the Conservatives has left Britain worse off and trapped in a low development, excessive tax cycle.’

Requested in regards to the newest GDP information, Chief Secretary to the Treasury John Glen informed Sky Information: ‘I feel what it exhibits is there’s lots of resilience within the UK financial system. We noticed a report improve from the IMF of 0.7 per cent larger for the UK financial system this yr. That is welcome information. After I began in workplace nine-and-a-half months in the past, recession was predicted.

‘After all, , I would really like that determine to be larger, however we’re in the midst of the pack with respect to our friends within the G7.

‘Germany’s is definitely flat, Italy’s minus 0.3 per cent. So, we have got lots of work to do, but additionally within the context of the inflation pressures we see within the financial system in the mean time, it is clearly a fragile balancing act as a result of we need to take care of that inflation, which is a large affect for enterprise confidence and for households as we all know, and clearly it’s extremely troublesome to realize larger ranges of development while you’re coping with inflation pressures.’

Requested in regards to the Prime Minister’s pledge to develop the financial system by the tip of the yr, Mr Glen stated: ‘We had the very best development final yr within the G7 and we’re predicted in 2025 to get again as much as that degree.

‘However you will not anticipate me to commentate on the result of one thing that can take all yr. We’re at half-time.’

#financial system #grows #quarter #yr